[+1-888-888-8880] (TTY:711)

A Licensed Insurance Agent will answer your call.

[+1-888-888-8880] (TTY:711)

A Licensed Insurance Agent will answer your call.

A Licensed Insurance Agent will answer your call.

A Licensed Insurance Agent will answer your call.

You can start by enrolling in Medicare Parts A & B to access essential healthcare coverage. Part A covers hospital stays, while part B includes doctor visits and medical services.

Medicare Part C, also known as Medicare Advantage, for comprehensive healthcare coverage. Part C combines Parts A & B and often includes one or more of the following benefits like dental or vision or hearing.

Medicare Part D is your solution for prescription drug coverage. With Part D, you can access affordable medications through private insurance plans approved by Medicare

Disclosure: We represent Medicare Advantage HMO, PPO and PFFS organizations and stand-alone PDP prescription drug plans that are contracted with Medicare. Enrollment depends on the plan’s contract renewal.

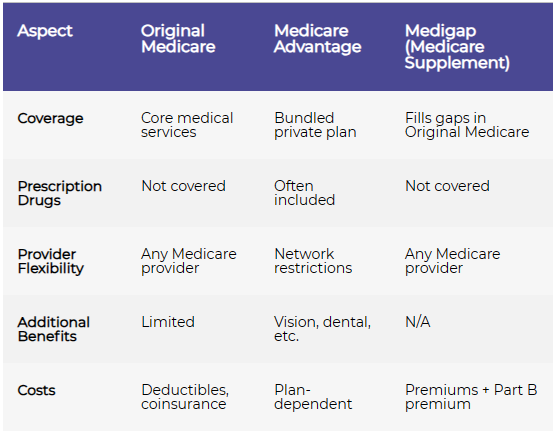

Let’s explore Original Medicare, Medicare Advantage, and Medigap (also referred to as Medicare Supplement) to clarify their key differences. Each of these choices serves a unique purpose in offering healthcare coverage for eligible individuals.

Most U.S. citizens or permanent residents age 65 or older are eligible for Medicare. Additionally, individuals under 65 may qualify if they have certain disabilities or specific medical conditions, such as end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS).

Initial enrollment typically begins three months before your 65th birthday and lasts for seven months. It's crucial to enroll during this period to avoid potential late enrollment penalties. If you miss your initial enrollment period, you can sign up during the annual enrollment period, but you may face higher premiums.

Original Medicare only covers Parts A and B but a Medicare Advantage plan may include everything in Parts A and B and may include Part D, prescription drug benefits.

While Part A is generally premium-free for most people, Parts B, C, and D may involve premiums, deductibles, coinsurance, and copayments. Costs can vary depending on factors like income, the specific plan chosen, and whether or not the individual receives assistance from programs like Medicaid.

Yes, many people have additional coverage alongside their Medicare benefits. This could include employer-sponsored coverage, retiree health benefits, Medicaid, or Medigap (supplemental insurance) plans, which can help cover costs that Medicare doesn't pay for, such as copayments, coinsurance, and deductibles. However, it's essential to understand how these plans coordinate with Medicare to avoid unnecessary expenses or coverage gaps.

6 Landmark Square Suite 400

Stamford, CT 06901

Disclaimer:

We do not offer every plan available in your area. Currently, we represent twenty-seven (27) organizations nationally which offer 128,950 products nationally. Please contact Medicare.gov, 1–800–MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options. Callers will be connected with a licensed insurance agent partner of Quantum Health, LLC., a Quantum Digital Media, Inc. licensed insurance agency, it is not a government agency, who can provide more information about Medicare Advantage plans offered by one of the or several Medicare-contracted carrier(s). There is no obligation to enroll. We are not affiliated with or acting on behalf of any government agency or program. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply. Plans are insured or covered by a Medicare Advantage (HMO, PPO and PFFS) organization with a Medicare contract and/or a Medicare-approved Part D sponsor. Enrollment in the plan depends on the plan’s contract renewal with Medicare. Allowance amounts cannot be combined with other benefit allowances. Limitations and restrictions may apply. SMID Code: [MULTIPLAN_CFX2025032_M]

SSBCI Disclaimer:

Applies to all carriers except United Healthcare: Benefit(s) mentioned may be part of a special supplemental program for chronically ill members with one of the following conditions: Diabetes mellitus, Cardiovascular disorders, Chronic and disabling mental health conditions, Chronic lung disorders, Chronic heart failure. This is not a complete list of qualifying conditions. Having a qualifying condition alone does not mean you will receive the benefit(s). Other requirements may apply.

© PolicyFetch All rights reserved.